Enhancing Security with Biometrics

Learn how biometric technologies are shaping secure digital transactions.

- Facial Recognition

- Increased Security

- User Convenience

- Fraud Prevention

Paysafe Verify is a comprehensive verification system crucial for securing digital transactions and ensuring compliance with KYC regulations.

Paysafe Verify stands as a vital process in the digital transactions landscape, ensuring security and compliance through rigorous user identity confirmation. As more consumers seek safe and efficient payment methods, the relevance of Paysafe Verify cannot be overstated. This comprehensive verification process not only protects users from fraud but also aligns with regulatory standards, making it essential for online transactions.

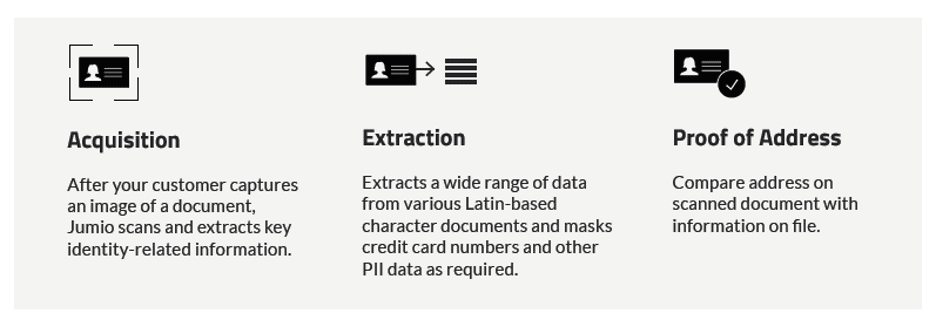

Paysafe Verify is a multi-layered verification system integral to the Paysafe financial services ecosystem, designed to authenticate users and secure transactions. By implementing this rigorous verification process, Paysafe alleviates risks associated with fraud while complying with Know Your Customer (KYC) regulations. The essence of Paysafe Verify is to verify identity and address information before allowing users access to financial services, establishing a safe environment for all digital transactions.

The KYC process within Paysafe Verify encompasses several critical steps that customers must complete for identity verification. These steps typically include:

This KYC process is administered through a dedicated UI, guiding users step-by-step through document submissions and verification processes to ensure a smooth onboarding experience.

Learn how Paysafe Verify ensures secure transactions through a multi-layered verification process.

Explore the technology and methods behind Paysafe's robust security framework.

To kickstart their verification process, users are typically directed to the Paysafe’s KYC application. Here’s how the user experience unfolds:

This structured user experience minimizes confusion and helps users understand their steps through the verification journey.

Paysafe employs diverse identity verification methods to ensure the authenticity of users and their transactions. These methods include:

This multi-method approach enhances Paysafe's ability to mitigate fraud while assuring compliance with global regulatory standards.

Paysafe also places significant emphasis on transaction verification. This includes several preventative measures, such as:

These layers of transaction verification work cohesively to protect both users and merchants from the threats associated with fraudulent transactions, reinforcing trust in the Paysafe ecosystem.

Within the Paysafe environment, the verification of bank accounts plays an integral role. This verification ensures that all transactions are executed through legitimate accounts linked to verified user identities. By doing so, Paysafe minimizes the risks of fraud and chargebacks, fostering a secure transaction landscape.

To ensure a bank account is verified under the Paysafe system, users typically undertake the following steps:

Following these steps strengthens the legitimacy of user accounts, contributing to a secure payment framework.

Meet our trusted partners who help us secure digital payments worldwide.

Learn how biometric technologies are shaping secure digital transactions.

Explore how KYC processes are evolving within the financial sector.

Paysafe has announced a new partnership with a leading bank to enhance its verification capabilities.

Biometric technologies continue to dominate digital security solutions, with new advancements being made every day.

New KYC regulations set to take effect in 2026 might change how financial service providers operate.